Key Findings:

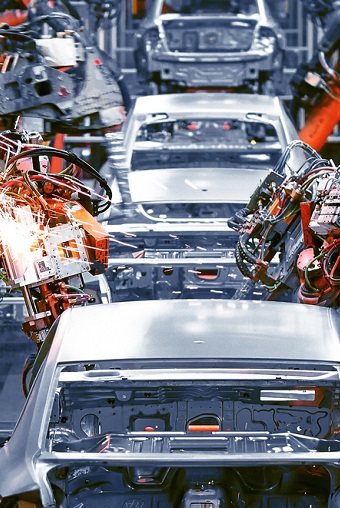

A complete market research report, including forecasts and market estimates, technologies analysis and developments at innovative firms within the Manufacturing, Automation & Robotics Industry. Gain vital insights that can help shape strategy for business development, product development and investments.

Key Features:

- Business trends analysis

- In-depth industry overview

- Technology trends analysis

- Forecasts

- Spending, investment, and consumption discussions

- In-depth industry statistics and metrics

- Industry employment numbers

Additional Key Features Include:

Industry Glossary

Industry Contacts list, including Professional Societies and Industry Associations

Profiles of industry-leading companies

- U.S. and Global Firms

- Publicly held, Private and Subsidiaries

- Executive Contacts

- Revenues

- For Public Companies: Detailed Financial Summaries

Pages: 682

Statistical Tables Provided: 25

Companies Profiled: 500

Geographic Focus: Global

Price: $399.99

Key Questions Answered Include:

- How is the industry evolving?

- How is the industry being shaped by new technologies?

- How is demand growing in emerging markets and mature economies?

- What is the size of the market now and in the future?

- What are the financial results of the leading companies?

- What are the names and titles of top executives?

- What are the top companies and what are their revenues?

This feature-rich report covers competitive intelligence, market research and business analysis—everything you need to know about the Manufacturing, Automation & Robotics Industry.

Plunkett Research Provides Unique Analysis of the Following Major Trends Affecting the Manufacturing, Automation & Robotics Industry

- Introduction to the Manufacturing, Automation & Robotics Industry

- Industrial Robots and Factory Automation Advance Through Artificial Intelligence (AI)

- Service Robots Are Applied in a Variety of Industries/Rapid Growth in Robotics for Warehousing & Logistics

- U.S. Automobile Manufacturers Drop Sedans and Deal with Supply Chain Issues/Retool for Electric Vehicles (EVs)

- Global Growth in Manufacturing and Trade Require Investment by Emerging Nations

- Introduction to the Outsourcing & Offshoring Industry

- Pros and Cons of Outsourcing & Offshoring

- Nearshoring and Reshoring Keep Operations Closer to Home

- Upswing in the U.S. Apparel and Textile Sector as Firms Reshore

- Scarcity of Manufacturing Workers in China/Vietnam, India and Other Countries Gain Manufacturing Market Share

- The Vast Majority of Shoes Sold in the U.S. Are Made Elsewhere

- 3-D Printing and Robotics Revolutionize Manufacture of Shoes and Fabrics

- Original Design Manufacturing (ODM) Adds Value to Contract Electronics Manufacturing

- Trends in Manufacturing, such as Original Design Manufacturers (ODMs), Lead to Collaboration and Consulting-Like Services

- 3D Printing (Additive Manufacturing), Rapid Prototyping and Computer Aided Design

- 3PL Logistics Services and Supply Chain Management Services Soar

- Manufacturers Focus on High Performance Plastics and Specialty Chemicals

- Refineries Along with Chemicals and Plastics Plants Expand in the U.S.

- Telecom Equipment Makers Face Intense Competition from Manufacturers in China

- Boeing and Airbus Compete for New Orders

- U.S. Auto Manufacturers Ford, Stellantis and GM Compete Head-On with Volkswagen, Toyota and Honda

- India Has a Significant Automobile Market, with Great Long-Term Potential

- Mexico Is a Leading Automotive Maker and Exporter

- Designers and Manufacturers Bypass the Middleman with Direct-to-Consumer Online Business Models

- Artificial Intelligence (AI), Deep Learning and Machine Learning Advance into Commercial Applications, Including Health Care and Robotics

- The Internet of Things (IoT) in Factories, Robotics and Equipment

- Health Care Robotics

- Robotics in Retailing and Ecommerce Fulfillment

Plunkett Research Provides In-Depth Tables for the Following Manufacturing, Automation & Robotics Industry Statistics

- Overview of the Manufacturing, Automation & Robotics Industry

- Manufacturing, Automation & Robotics Industry Statistics and Market Size Overview

- Sales & Net Income After-Tax, U.S. Manufacturing Corporations: 2012-2nd Quarter 2023

- Sales & Operating Profits, U.S. Manufacturing Corporations, by Industry: 1st Quarter 2022-1st Quarter 2023

- Output & Employment

- Value Added to U.S. Economy by Manufacturing Sector, as a Percentage of GDP: 1950-2021

- Employment in the U.S. Manufacturing Sector, as a Percentage of all Private Industry Employment: 1950-2020

- Employment in the U.S. Manufacturing Sector, by Industry: 2017-June 2023

- Manufacturing Output vs. Employment, U.S.: 1980-2023

- Gross Output in the Wood & Nonmetallic Mineral Products Manufacturing Industries: Selected Years, 2016-2021

- Gross Output in the Primary Metals & Fabricated Metal Products Manufacturing Industries: Selected Years, 2016-2021

- Gross Output in the Machinery Manufacturing Industry, U.S.: Selected Years, 2016-2021

- Gross Output in the Computer & Electronic Product Manufacturing Industries: Selected Years, 2016-2021

- Gross Output in the Electrical Equipment, Appliances & Components Manufacturing Industries: Selected Years, 2016-2021

- Gross Output in the Motor Vehicles & Transportation Equipment Manufacturing Industries: Selected Years, 2015-2021

- Gross Output in the Food, Beverage & Tobacco Product Manufacturing Industries, U.S.: Selected Years, 2016-2021

- Gross Output in the Textile & Apparel Manufacturing Industries, U.S.: Selected Years, 2016-2021

- Gross Output in the Chemicals, Plastics & Rubber Products Manufacturing Industries, U.S.: Selected Years, 2016-2021

- Shipments

- Annual Value of Manufacturers' Shipments for Industry Groups, U.S.: 2016-2022

- Exports

- Value of Exports of All Manufactured Goods, U.S.: 2017-August 2023

- Exports of Durable & Nondurable Manufactured Goods, U.S.: 2017-First Half 2023

- Value of Exports of U.S. Vehicles: 2017-2022

- Exports, Imports & Trade Balance of Computers & Electronic Products, U.S.: 2017-2022

- Exports, Imports & Trade Balance of Chemicals, U.S.: 2017-First Half 2023

- Top 50 Destinations of U.S. Textiles & Apparel Exports: 2021-2022

- Top Ten Suppliers & Destinations of U.S. Computers & Electronic Products: 2017-First Half 2023