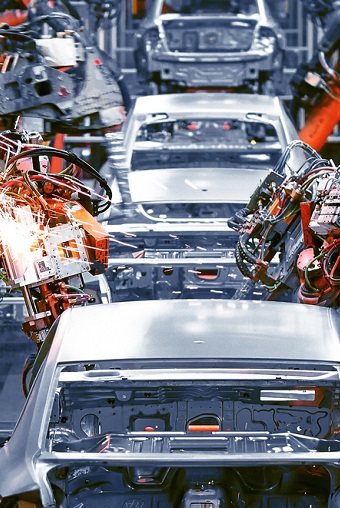

Asian companies have become world-class competitors in an amazing variety of fields. While consumer and industrial electronics, as well as apparel and household items, have been a prime focus at Asian firms, their ability to compete and innovate has also spread successfully to such fields as solar power, automobiles, transportation equipment, telecommunications switches, power equipment, food products and pharmaceuticals. Recently, a significant emphasis in research and development has been placed on wireless technologies, biotechnology, nanotechnology, communications, aerospace and high-speed railways.

This exciting new book profiles 500 of Asia’s leading companies, in industry sectors of all types. These firms are headquartered in Asia’s largest economies, including: Japan, China (including Hong Kong and Macau), India, Singapore, Taiwan, Thailand, Indonesia, Malaysia, South Korea, The Philippines and Pakistan.

The firms have been filtered from our extensive, proprietary corporate information database. The Asian companies chosen include both private and publicly-held companies. They include all major industry sectors. Consequently, the list includes Asian sectors that we believe users will most want to analyze and/or market to, such as electronics manufacturing, automotive, retail, financial services, food products, transportation, hotels, real estate development, health products, steel, biotechnology, construction, engineering, apparel and more. Plunkett’s Asian Companies is especially designed to assist professionals involved in business development, investment, marketing, import, export, consulting, strategy and product development.

You'll find a complete Asian companies research report in one superb, value-priced package. Features include company profiles (both private and publicly-held), a table of Asian economic data, executive contacts, a glossary and a thorough list of leading industry associations and professional societies.

You will find everything you need to identify and develop strategies for dealing with Asian firms, including:

- Profiles of Asian manufacturers of all types

- Profiles of major diversified holding companies and business groups

- Profiles of leading financial firms, banks, investment companies and insurance firms

- Profiles of Asian technology, hardware and software firms

- Leading telecommunications and wireless firms, including equipment makers and service providers

- Profiles of leading transportation firms, including airlines

- Companies in energy, food products, outsourced and offshore services, consulting, real estate and engineering

- A business terms glossary

- A comparative table of Asian economies

- A directory of vital industry associations, professional societies and government agencies

Whether you purchase the printed almanac or buy a subscription to the online edition, you will find a complete overview, industry analysis and market research tool in one superb, value-priced package.

We provide you with our famous industry trends analysis, statistical tables, and a glossary, along with a database of industry contacts including associations and professional societies. And you receive our proprietary, in-depth profiles of hundreds of leading companies in all facets of this industry—public and private companies, U.S. and non-U.S. based.

Electronic Access to Company Profiles: Our online data enables you to search, filter and view selected companies, and then export contact data into text or Excel, including executive names with titles, plus the company addresses and phone numbers.